Everything About Cash Money Breakthrough: Discovering Qualification Standards and Advantages of Cash Advance

Cash money developments and cash advance function as immediate monetary remedies for those in requirement. They offer fast accessibility to funds with very little requirements. However, potential borrowers must browse particular eligibility standards. Recognizing these elements is vital for making informed decisions. Furthermore, the risks and advantages connected with these financial items necessitate cautious factor to consider. What should one keep in mind prior to selecting such lendings?

Recognizing Cash Loan: Interpretation and Purpose

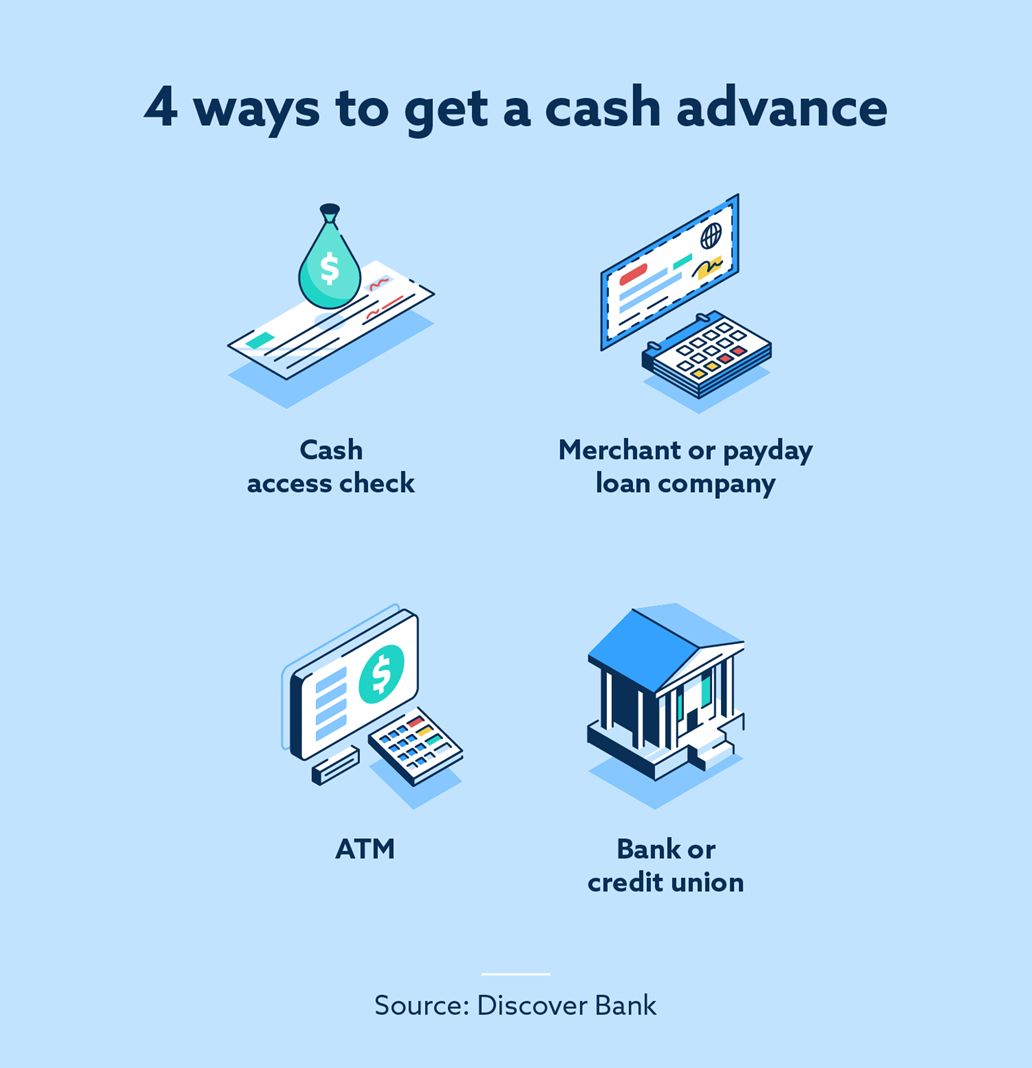

A money advance works as a temporary financial option for individuals dealing with immediate capital difficulties. It permits customers to access a section of their future earnings or credit history limitation prior to the scheduled payday or payment cycle. Usually supplied by charge card issuers or with cash advance solutions, cash money breakthroughs provide fast accessibility to funds without the prolonged authorization processes connected with typical car loans.

The key objective of a cash loan is to bridge financial gaps, making it possible for people to cover unexpected expenses such as medical bills, cars and truck repair services, or immediate family demands. Though convenient, money breakthroughs often come with higher rate of interest and charges compared to conventional financings, making them an expensive option if not settled quickly. Recognizing the nature and effects of cash money advancements is crucial for individuals to make informed economic choices and prevent prospective mistakes related to loaning.

Common Qualification Criteria for Cash Loan

Qualification for cash breakthroughs usually pivots on several vital factors that loan providers take into consideration prior to approving a demand. To begin with, candidates should go to the very least 18 years of ages and provide proof of identification. A stable income source is additionally important, as it shows the capacity to pay back the funding. Lenders frequently need a savings account, which facilitates the deposit of funds and settlement. Additionally, a minimum revenue limit is frequently set, making sure that borrowers can manage the payment terms. Some loan providers might also inspect credit report, although numerous cash loan choices are readily available to those with less-than-perfect credit report. Ultimately, residency status may play a function, as some lending institutions just offer particular geographical locations. Comprehending these criteria can assist potential borrowers evaluate their qualification before getting a cash loan.

The Application Refine: What to Anticipate

They can expect a simple procedure that commonly involves numerous crucial actions when borrowers make a decision to use for a cash money advancement. First, they must complete an application, which is normally readily available online or at a physical area. This form calls for personal info, including identification, revenue details, and banking information.

After accepting the deal, funds are commonly disbursed promptly, sometimes within the very same day. Borrowers ought to be prepared to assess the car right here loan contract thoroughly before signing, ensuring they recognize all problems. On the whole, the application process for a money breakthrough is designed to be effective, permitting borrowers to access funds in a timely way when required.

Benefits of Cash Developments and Cash Advance Loans

Cash advances and payday lendings are typically seen click here now with care, they provide several advantages for customers dealing with immediate financial needs. One substantial advantage is the fast access to funds. Borrowers can usually get money within a brief time structure, typically as quickly as the following organization day, permitting them to attend to urgent expenditures such as clinical bills or vehicle repairs.

In addition, these fundings usually require marginal paperwork, making the application process accessible and uncomplicated, particularly for those without a solid credit rating. Cash money developments and payday lendings likewise provide adaptability concerning lending amounts, enabling borrowers to request just what they require.

They can help people connect the space in between incomes, guaranteeing that essential expenses are paid on time and protecting against late fees. Overall, for those in a tight economic spot, these loans can function as a useful temporary solution.

Liable Borrowing: Tips for Handling Short-Term Loans

Numerous consumers find it necessary to embrace responsible borrowing methods when making use of temporary car loans like cash loan and payday advance - Cash Advance. Recognizing the terms and problems of the lending is fundamental; customers ought to read the small print to avoid covert fees. Creating a spending plan can help guarantee that repayment is manageable, permitting consumers to designate funds effectively without endangering their economic security. It is likewise a good idea to borrow only what is necessary, as obtaining bigger financings can result in more substantial settlement difficulties. Timely settlements are crucial to maintaining a favorable credit rating and staying clear of extra fees. Seeking choices, such as credit score counseling or various other loan alternatives, can offer even more sustainable economic services. By implementing these have a peek here strategies, debtors can navigate short-term car loans extra properly, lessening risks and promoting economic health in the future

Regularly Asked Inquiries

Can I Obtain a Cash Loan With Bad Credit Scores?

Yes, people with poor credit scores can obtain a cash advance. Several lending institutions think about alternative elements beyond credit history, such as revenue and employment background, offering options for those encountering monetary difficulties regardless of poor credit score rankings.

Exactly How Quickly Can I Get Funds After Authorization?

When accepted, individuals can typically get funds within hours or by the following service day, depending on the lending institution's policies and the technique of disbursement picked, such as direct down payment or check issuance.

Exist Any Charges Associated With Cash Advancements?

Cash loan typically sustain different fees, including purchase fees, rate of interest costs, and prospective solution charges (Cash Advance). These expenses can substantially increase the overall amount repayable, making it vital for people to review terms before continuing

Can I Repay a Cash Loan Early?

Yes, one can generally settle a cash loan early. This practice might aid reduce rate of interest expenses, yet it's advisable to inspect details terms with the lender to confirm any appropriate costs or conditions.

What Happens if I Can't Repay My Cash Advancement in a timely manner?

If an individual can not repay a cash loan in a timely manner, they might sustain late costs, increased rate of interest, or potential collection efforts. This could negatively affect their credit report and financial security substantially.

Cash advances and payday car loans serve as immediate financial services for those in requirement. A cash advance offers as a short-term economic remedy for people dealing with instant cash circulation obstacles. Hassle-free, cash money developments commonly come with higher interest prices and costs contrasted to conventional fundings, making them an expensive option if not settled promptly. Cash money developments and payday loans are usually seen with caution, they provide numerous benefits for borrowers encountering instant financial demands. Lots of borrowers discover it necessary to adopt liable borrowing techniques when using short-term financings like cash money breakthroughs and cash advance finances.